HDFC Share price VS HDFC Bank fixed deposit – HDFC BANK fixed deposit offers a maximum rate of 7% return on fixed deposit opened with the bank by any investor . For some people getting assured return on your investment with making the amount locked in banks seems comfortable . Investment in fixed deposit is risk free and does not involve any loss in capital but does it offer the highest return matching the inflation rate of the economy. Can you earn higher rates than investing in HDFC Fixed deposit if you are a hdfc customer ? You might be searching a solution to park your investment on a higher return than investing in a fixed deposit , if your investment is near to Rs 1 lakh .

In this article , we shall be discussing taking example of HDFC Share price and HDFC Fixed deposit , that which is the ideal investment for you to grow your money faster .

HDFC Bank Fixed Deposit for 1 Year

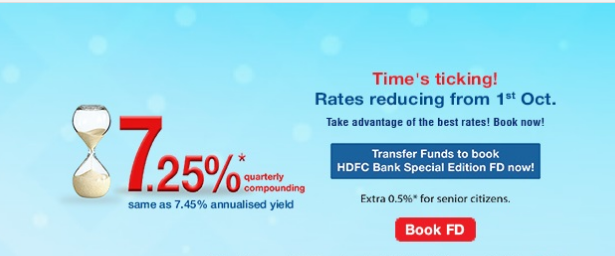

For a customer or non-customer of HDFC Bank , the return on investment provided by any fixed deposit is near to 7% in all cases. For an fixed deposit with HDFC bank of Rs 1 lakh in a year , you can earn 107000 for the year . The interest can be taken on monthly basis or even on yearly basis depending on your needs .

You can apply for a fixed deposit directly on the website of HDFC Bank , through HDFC Bank application or through use of hdfc netbanking . There are two ways you can create a fixed deposit with the bank , online or offline by visiting the nearby HDFC Bank branch.

HDFC bank is also listed in stock market where the current price of hdfc share in Sept , 2023 is near to Rs 1527 . The stock is listed on stock market and can be invested or traded online using a demat account . If you invested for Rs 1 lakh in April , 2022 for HDFC Bank share the total number of share with cost would be – 1388/- and for Rs 1 lakh invested in the bank share would be 72 shares .

In April , 2023 the stock was valued at 1690 making the investment growth of = 1690-1388 = 302 per share making return of 302*72 shares = 21744 in a year which compared to fixed deposit is 3 times and provided a yeild of 21%.

For those want to know the power of stock market and those who want to see their funds growing can choose hdfc bank for their investment for long term , where the bank provided a return of the following in 3 years when compared to a fixed deposit .

For a fixed deposit made in April , 2020 of Rs 1 lakh invested in HDFC Bank , at the rate of 6 percent would yeild the following amount in 3 years :

With Simple Interest if interest is withdrawn every year = Rs 118000

With Compound Interest = 119101 .

With investing in HDFC Share price in 2020 at the price of Rs 999.25

Price of April 2021 – 1410 Return percent = 41%

Price of April 2022 – 1388 Return percent = 38%

Price of April 2023 – 1685 Return percent = 68%

The final profit in April 2023 would be – 68475 approx which is far better than fixed deposit .

An Ideal way of growing your investment is expecting a 7% return from the share market on your investment as quick as possible you can raise . Now , you can withdraw your money from the fixed deposit and invest the profit amount in more stocks and do the rest amount in fixed deposit for the remaining period . Here , you will benefited of the time duration left for growing of your investment .

Also , you can withdraw your profits and can use in your business and keep the money invested in the market until it raises you profit . Working with stop loss would be recommended.

Also read : Grow your Money by 15% Return against Inflation Rate with these Options in a Year

With better returns , there are also risk involved in investing in share market compared to fixed deposit. If you consider no other option than investing your money in fixed deposit , then you can prefer to make deposit in share market and invest in the most secure share HDFC bank where you can withdraw your funds at anytime . Also , you can opt to buy hdfc share on monthly basis also to increase your returns.

The risk involved in HDFC Share price is reaching of the stock near to its lower circuit or low . In all cases , learning about stop losses and maintaining proper stop losses would be recommended.

From HDFC Shares , you take your profits earned in the market from the demat account by selling the stock at anytime during the year by booking some losses . Also , you can place stop loss every day in the morning in your portfolio to avoid losses.

For fixed deposit , you can take your money only after the end of the fixed deposit . In case you withdraw in between you will end up loosing your interest income.

Can you start earning good returns from low investment ?

Yes , if your investment is as low as Rs 1 lakh you can ignore fixed deposit or recurring deposit and directly make investment in HDFC Share .

How to minimize loss while Investing in Stock Market that fixed deposit ?

The best way to minimize losses in investing in any stock is by choosing stock which existed in market for more than 5 years and are still outperforming . Also, work with a definite stop loss and do not hold the loosing stock more than 10% stop loss .

Also read : Investment in Indian Stock Market : Is it Profitable or Drowning of Investment

In case , you only hold Rs 1 lakh as a your savings and have no other deposits than it is not advisable to invest in stock market . Also , taking a loan for investing in stock market for returns could be a risky process.

Note : We are not SEBI Registered entity so we are not offering any investment advice . Invest after proper analysis and taking advice of some professional market expert.